In the last couple of years, the Crystal Coast has seen strong growth in primary home ownership, second home purchases, and vacation rental purchases. The work-from-home policy changes we saw from many employers and what I call the live-where-you-play movement have driven much of this growth.

In addition, investors have seen opportunities unfold along the Crystal Coast as word spreads of the future Interstate 42, which will shorten drive times between the area and the Research Triangle region. They recognize many areas along this part of the coast are undervalued compared to similar markets elsewhere, much like what Wilmington, NC, experienced when I-40 connected it to Raleigh.

In our new report, we take a look at the underlying reasons coastal homes remain a good investment. We look at pricing trends nationally and regionally, and we look at who the new buyers are and why they’ve entered the market.

What will the coming months bring? Hard to say. I do know that the fundamentals haven’t changed: Supply still does not meet demand. Interest rates may have crimped demand, but there has been no drastic drop in housing prices. And savvy buyers are acting quickly.

55%

Inventory compared to 2019

33

Days on Market, vs 64 in 2019

5.4%

Sale price increase this year

$360,801

Average sale price

Source: North Carolina Regional MLS

In the wake of the market frenzy

In many areas along the Crystal Coast, home prices have not dropped. The rate of price acceleration has slowed, but the average sale price in the area is up 5.4% so far this year.

While predictions for housing prices abound, two leading sources of real estate analysis — the National Association of Realtors and Fannie May — predict that home prices will either rise 1.2% in 2023 (NAR) or potentially fall by only 1.5% (Fannie May).

Housing inventories have been low for a long time

The low supply of houses isn’t a result of the market frenzy of the last couple of years. We’ve had a shortage since the housing crisis of 2008. Soon after that crisis, builders stopped building, and inventories never caught up. During the first year of Covid, we felt the true impact of that shortage, one that is even worse today.

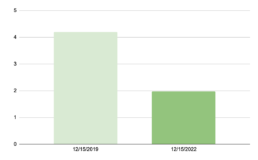

Months of supply, Dec 2019 vs. Dec 2022 (Source: NCR MLS)

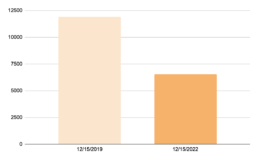

Active listings, Dec 2019 vs. Dec 2022 (Source: NCR MLS)

Homes continue to move quickly

Another result of low inventory is that homes continue to sell quickly. The average days on market for a residential listing along the Crystal Coast is 33, less than half of the 68 days this time in 2019. Buyers are still acting quickly on the limited number of available homes.

Less new home building

Yet another factor affecting home prices is the slowdown in new home construction. Spec builders pull back during recessions — and the lack of supply of new homes influences the price of existing homes. And remember, new home supply shortages existed prior to Covid, a lingering result of the housing crisis 12 years earlier. This shortage of new homes could lessen recessionary effects on prices.

The buyer pool has changed

During the last two years, when interest rates on mortgages were at historic lows, home ownership was affordable for a greater-than-ever number of buyers. But higher interest rates have pushed these buyers out of the market, specifically since home prices have not dropped significantly. And so the buyer pool has shifted. It has seen an influx of buyers who either qualify for homes at today’s prices and interest rates or are cash buyers.

These buyers face less competition for new listings and are more likely to go under contract earlier in the process — giving them a better shot at their first-choice homes instead of settling for a second or third choice. Non-cash buyers who finance their purchases could have the opportunity to refinance in a few years if rates drop back down.

Improved and quicker access to the Crystal Coast

Another advantage for the Crystal Coast is the US 70 Corridor Improvement — future Interstate 42. Once fully completed, drive times to and from the Triangle will be roughly equal to that of Wilmington, NC. As a result, the Crystal Coast is experiencing an onset of growth similar to that of Wilmington in the late 1980s — when I-40 was constructed from Raleigh. With coastal vacation properties still undervalued in comparison to similar markets, the timing couldn’t be better for taking advantage of investment opportunities along the Crystal Coast.

Download the report

We take a look at opportunities in today’s housing market in our new report, “Why a Coastal Home Remains a Good Investment.” The report helps sellers and buyers make better decisions around timing and offers-to-purchase during this period of rising interest rates, low housing inventory, and persistent demand.

[…] December, we published our report “Why a Coastal Home Remains a Good Investment” after studying the effects of the new interest rate environment on home prices along the North […]