The real estate market is currently undergoing significant shifts, influenced by a combination of higher interest rates and a low housing supply. This dynamic environment presents a unique set of challenges and opportunities for buyers, sellers, and investors alike. In this article, we will delve into the various aspects of the current real estate market, examining the impact of these factors on home prices and exploring potential solutions and future outlooks.

And be sure to check out our video. It’s filled with key insights to help you with your real estate decisions.

Impact of Higher Interest Rates

Affecting Purchasing Power

Higher interest rates directly impact buyers’ purchasing power. As rates increase, the cost of borrowing money for a mortgage also rises. This means that for many potential homeowners, the monthly payments for a given home price become less affordable, effectively reducing their purchasing power.

Demand and Mortgage Rates

Increased mortgage interest rates can lead to a decrease in demand for homes. As borrowing costs rise, some buyers may be priced out of the market, while others might opt to delay purchasing in hopes of more favorable rates in the future.

Home Affordability

The relationship between higher interest rates and home affordability is a complex one. Higher rates can lead to a cooling-off period in overheated markets, potentially leading to more balanced conditions. However, in the short term, these rates can significantly impact affordability, especially for first-time buyers and those with limited budgets.

Influence of Low Housing Supply

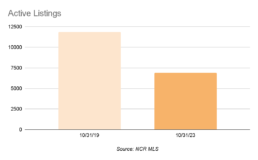

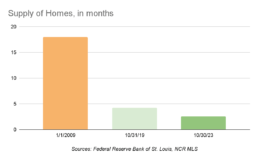

Scarcity of Homes

The current scarcity of homes for sale has become a defining feature of many real estate markets. This lack of inventory limits buyer options and contributes to heightened competition for available properties.

Impact on Buyer Options

With fewer homes on the market, buyers face limited choices and increased competition. This often leads to bidding wars, driving prices up and making the home buying process more challenging.

Contribution to Price Increases

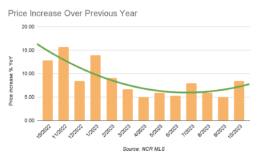

The low housing supply is a critical factor in the ongoing increase in home prices. Limited inventory coupled with steady or increasing demand tends to push prices upward, sometimes at an accelerated pace.

Effects on Home Prices

Combined Impact

The interplay between higher interest rates and low housing supply creates a unique scenario for home prices. While higher rates might typically cool the market and lower prices, the low supply counteracts this effect, often leading to continued price increases.

Regional Variations

Home price trends can vary significantly by region. Some areas might experience more pronounced effects due to local economic conditions, the balance of supply and demand, and other regional factors.

Implications for Buyers and Sellers

Both buyers and sellers must navigate these complex conditions. Sellers may benefit from higher prices, but if they are looking to buy another home, they face the same challenges as other buyers. Conversely, buyers might find it difficult to afford a home, but those who can may benefit from less competition if rising rates deter other potential buyers.

Potential Solutions and Future Outlook

Addressing Challenges

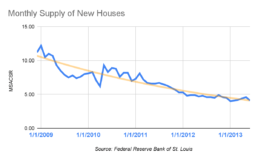

To address the challenges of higher interest rates and low housing supply, stakeholders might consider various strategies, such as government incentives for home building, policies to make financing more accessible, or creative housing solutions.

Market Outlook

The outlook for the real estate market in light of these factors is uncertain. While some predict a stabilization or even a downturn in prices, others anticipate continued growth, albeit at a potentially slower pace.

Long-term Effects

The long-term effects on the housing market may include adjustments in buyer preferences, shifts in geographic demand, and potential changes in lending practices.

Conclusion

Navigating the current real estate landscape requires an understanding of how interest rates and housing inventory affect home prices. While the market presents challenges, it also offers opportunities for informed decision-making.

We’re in a new interest rate environment for the short term. But because of this huge shortage of homes, we’re in a new price environment for a much longer period — until new-home construction catches up. The law of supply and demand underpins everything that’s going on right now with home prices. This current scarcity of homes for sale is the defining feature of the real estate market right now. Prices are still increasing because there aren’t enough homes for sale.